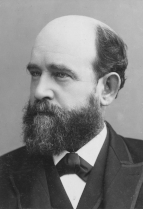

Henry George’s Progress and Poverty (1879) was among the most important and widely read books published in the 19th century, but George’s work and the single tax movement it spawned had largely faded common knowledge by the 1930s. George’s central idea was that a single tax on land values was sufficient to fund the government, and that private appropriation of land’s value was the cause of the persistence of severe poverty even in the richest and most developed cities in the world. Today, Georgist ideas are beginning to receive renewed interest, as housing affordability has become a political issue around the world, making this a good a time to revisit this important text.

https://www.econlib.org/library/columns/y2024/forresterpovertysolution…

Books 1 and 2—Critique of Previous Political Economy

The first two books of Progress and Poverty identify the flaws of other systems of political economy George’s his day—most notably those of John Stuart Mill, Adam Smith, David Ricardo, and Thomas Malthus. The prevailing view held that there continued to be poverty despite enormous material advances, because the wages of labor were drawn from society’s stock of capital, which was being split among an ever-growing number of people as a result of population growth and international competition. The remedy would thus seem to be protectionism and population control.

George’s first critique is that these authors do not use terms in a consistent and clear way. To this end, George offers definitions of terms that will be needed for the rest of the book:

• Land—”the entire material universe outside man himself” (22) to include land, but also minerals, air, water, etc.

• Labor—all human exertion.

• Wealth—”a natural product that has been secured, moved, combined, separated, or in other ways modified by human exertion.”

• Capital—the portion of wealth that is devoted to producing more wealth.

Land, labor, and capital are the three factors of production for George, as for the other classical political economists. Anyone familiar with contemporary economics will know that theories today possess just two factors of production: labor and capital—lumping capital and land together. George’s system should be of interest to us, in part, because it is arguably the most well-developed system of political economy that considers land as a distinct factor of production.

George also believed that there is a relation of logical priority among the factors of production. Land is prior to labor, because no labor could be exerted if there were no resources to exert it upon. Land can exist without labor, but labor cannot exist without land. Labor is prior to capital, because labor can be exerted to produce something without the aid of capital (think here of a Robinson Crusoe who must produce at first without the aid of any tools), but capital cannot produce without labor. Other political economists proceed incorrectly by examining capital first and holding that wages are drawn from capital. Instead, argued George, political economy should proceed from the ground up, as it were.

Though George shares Smith’s fundamental insight that the division of labor is genesis of the overwhelming share of society’s wealth, he departs from Smith by holding that the wages of laborers derive from the productive power of labor, not from a fixed capital stock. The priority of labor over capital just discussed establishes this. Chapters 3 and 4 of Book 1 contain several further arguments for this conclusion.

In chapter 2, George relentlessly attacks the prevailing theory that overpopulation is the cause of poverty. His argument boils down to this simple idea: the more people there are, the further the division of labor can advance. Since the division of labor is the fundamental cause of wealth—because it makes workers more productive—an increase in population can never, by itself, cause society to become poorer since workers’ wages are determined by their productivity. For this reason, George even speculates, contra Malthus, that the Earth could easily support a trillion people or more.

Books 3 to 5—The Science of Distribution

Book 3 is the most theoretical and abstract of the entire work. Its aim is to derive an entire theory of the distribution of the social surplus among the three factors of production. George derives this from the fundamental axiom of social science: people seek to gratify their desires with the least exertion. From this fundamental principle follows Ricardo’s law of rent: the rent that land commands is the difference between the productivity of that land and the productivity of the least productive land in use, the so called “margin of production.” The insight that animates this book is George’s realization that the margin of production determines not only rent, but also the rate of wages and the rate of interest on capital. Chapter 5 examines the former and chapter 6 examines the latter. Capital, according to George, is just human labor impressed upon matter. Capital is labor stored up on material form. Hence, capital’s share of the social product is just a special case of labor’s share.

The law of rent holds for urban land as well as agricultural land. Two lawyers of equal skill, with identical law school transcripts, etc., go to work in Cleveland and New York. The one in New York earns three times more over the course of his career than the one in Cleveland because he is “working more productive land,” that is, he is much more productive because he works in the center of the global knowledge economy and thus has access to more connections, knowledge and opportunities than the lawyer in Cleveland. But, the owners of the land in New York are able to appropriate a significant portion of the excess value that this lawyer produces. The rent for his apartment is 5-10 times as much than a Cleveland apartment would be, and higher rent is baked into the price of all of the goods and services he buys in New York. So, even though the lawyer in New York is more productive and earns a higher wage, his wage after rent is likely much more similar to his colleague in Cleveland. Wages are determined by the margin of cultivation, even for professional jobs in the knowledge economy.

Once George derives the theory of wages and interest in this static context, he moves on in Book 4 to study the laws in a dynamic context: how does the share of the social product received by landowners, workers, and capitalists evolve under conditions of material progress. The short answer is, when there is economic growth, caused by increase in population or productivity, rent will continuously increase as well. When there are more people the margin of production expands, increasing rent and decreasing wages. And when productivity increases, the difference in productivity between the best land and the margin of production increases, increasing rent and decreasing wages. So, for George, the main reason why material progress does not improve the lives of everyone is that much of the wealth created by material progress goes to landowners as rent, not to workers. Were George alive today, the fact that workers in our most productive cities often spend a majority of their incomes on rent (and even more on the indirect rent that is baked into the prices of goods and services) would likely strike him as a confirmation of his view.

In Book 5, George derives his theory of the business cycle from the rest of his theory. Land speculation plays a key explanatory role. In countries with economic or population growth, land prices sometimes grow too fast out of speculative anticipation. When this happens, useful land is left idle for speculative purposes and the economy under-produces. This underproduction ripples through the rest of the economy to cause an industrial depression. George, as a newspaperman in San Francisco in the 1860s and 1870s, saw this process happen first hand. Land prices in San Francisco soared in the lead up to the completion of the transcontinental railroad in 1869. But it eventually turned out to be a bubble, and the correction in land prices caused more general economic turmoil. Rent and speculation do not play major roles in contemporary theories of the business cycle, though housing markets are undoubtedly important for understanding some downturns, as the Great Recession shows.

Books 7 to 9—Land Value Taxation: Justice and Efficiency

“George’s remedy to the problem of progress and poverty is to tax land and eliminate all other taxes.”

George’s remedy to the problem of progress and poverty is to tax land and eliminate all other taxes. George has two arguments for the land value tax, one based on justice (Book 7) and the other based on efficiency (Book 8).

Here is the simplified form of George’s argument that private property in land is unjust:

• People are only entitled to the value they create through their own labor.

• No individual created the value of land.

• Therefore, no individual is entitled to the value of land.

The first premise should be endorsed by any theorist in the liberal tradition. It embodies a liberal belief in self-ownership: no one is entitled to take what you create.

The second premise is what is more difficult to see. Let’s look at urban land again. There is a very small plot of land near where I live that is for sale for $550,000. First, no person created this land itself—that is the doing of God, or nature. Second, the owner of the parcel is not responsible for the parcel’s value. The parcel is worth so much only because it is situated near other things of value, close to the center of a prosperous city. George clearly recognizes the importance of cities:

Here is the heart, the brain, of the vast social organism… Here, if you have anything to sell, is the market; here, if you have anything to buy, is the largest and the choicest stock. Here intellectual activity is gathered into a focus, and here springs that stimulus which is born of the collision of mind with mind. Here are the great libraries, the storehouses and granaries of knowledge, the learned professors, the famous specialists. Here are museums and art galleries, collections of philosophical apparatus, and all things rare, and valuable, and best of their kind. Here come great actors, and orators, and singers, from all over the world. Here, in short, is a center of human life, in all its varied manifestations” (Chapter 4, Book 2).

In short, the parcel in my neighborhood is worth $550,000 not because of any efforts of its owners (a hole in the ground has no intrinsic value), but rather because of the positive externalities created by the activities of the millions of people who live within a 20-mile radius of the parcel. Since people are entitled only to the product of their own labor, the owner could not be entitled to the value of the parcel. Rather, the people of the city, who collectively created its value by their productive activities, are entitled to it.

George extends this argument in the next two chapters. He compares private ownership of land to slavery. He argues that private landownership leads to the (partial) enslavement of laborers: “it is the ownership of the soil that everywhere gives the ownership of the men that live upon it” (Book 7 Chapter 2). Since tenants have to pay part of their income in land rent (the portion of their overall rent that is due to the land, not the building), the landlord can appropriate part of the value that their labor creates as his own. George is attuned to this analogy because he wrote just two years after the end of Reconstruction, and he writes incisively about the failure of emancipation to truly free the formerly enslaved given emancipation was not accompanied by land reform. In the third chapter, he argues that if land value is socialized, current landowners are not entitled to compensation, for precisely the same reason that slaveowners were not entitled to compensation when their slaves were emancipated.2

Here we can see why it is so important to clearly distinguish land and capital as separate factors of production. George’s conclusion is that private property in land is unjust, and tantamount to slavery, though private ownership of capital—machines, technology, inventory, factories, intellectual property etc.—deserves the strictest protection, because capital is simply stored up labor. Karl Marx’s mistake was to analogize capital to land and to view private capital ownership as oppressive, but the mistake made by the neoclassical economists is to view land as just like capital, ignoring the fact that the owner of capital is entitled to it but the owner of land is not.

Let’s consider George’s efficiency-based arguments for land value taxation, which mainly appear in Books 8 and 9. In Chapter 2 of Book 8, George finally states his main policy proposal: “To abolish all taxation save that upon land values.” In the decades after the publication of Progress and Poverty, a social movement grew up around this “single tax” idea.

The efficiency-based justification of this is that land value taxes do not suffer from what economists now call deadweight loss, though other taxes do. The supply of natural resources is completely fixed independent of anything human beings do. So, when they are taxed, the supply of natural resources does not shrink. Compare this to taxes on labor, capital, or goods. When wages are taxed, people work less than they otherwise would. When capital is taxed, people save less. And when goods are taxed, in the form of tariffs or sales taxes, people produce and consume fewer goods. In technical terms, the supply of natural resources is completely inelastic, whereas the supply of everything else is elastic. This means that taxing anything other than land creates deadweight loss, economic value that is completely destroyed by the tax. By replacing taxes on wages, capital and goods with taxes on land, society would become much richer.

George carefully draws out the concrete implications of a shift to land value taxation. Real wages would rise through several different channels: the elimination of taxes on wages, the reduction in the price of all goods that workers buy, and the increased productivity of the entire economy. The rates of return on capital would increase, for the same reasons. Less social spending would be required, because the main thing that drives people into poverty in industrialized countries is the high cost of living. The land value tax is also easier to collect and less susceptible to arbitrary enforcement than other taxes.

Finally, George argues that the net effect of this change would be positive even for the vast majority of individuals who own land. To update his example in today’s terms: the largest proportion of the typical household’s net worth is the household’s primary residence. One might think that the proposal to socialize land value, as such, make most people worse-off. But perhaps 2/3 of the value of a typical residence is in the structure, not the land, so would be untouched by the land value tax. And for the typical household, their real income would increase much more than the amount of increased land taxes they would have to pay.

Conclusion

For more on these topics, see

Podcast episode Glen Weyl on Radical Markets. EconTalk.

Podcast episode Mike Munger on the Division of Labor. EconTalk.

Economic Growth, by Paul M. Romer. Concise Encyclopedia of Economics.

Bubbles, by Seiji S. C. Steimetz. Concise Encyclopedia of Economics.

Population, by Ronald Demos Lee. Concise Encyclopedia of Economics.

We have seen that George uses two ethical principles to argue for land value taxation: a deontological principle appealing to norms of justice and rights, and a consequentialist principle appealing to norms of efficiency and effects. George summarizes the appeal of land value taxation in these words: “Wealth would not only be enormously increased; it would be equally distributed. I do not mean that each individual would get the same amount of wealth. That would not be equal distribution, so land as different individuals have different powers and different desires. But I mean that wealth would be distributed in accordance with the degree in which the industry, skill, knowledge, or prudence of each contributed to the common stock” (Book 9, Chapter 3). Land value taxes would realize the ideal of a meritocracy, and solve the problem of progress and poverty.

Footnotes

[1] Henry George. Progress and Poverty. Originally published 1879, Doubleday, Page & Co. Online at the Library of Economics and Liberty.

[2] In some regions of the British empire, slaveowners were compensated when their slaves were emancipated, but this was a matter of political necessity. Slave-owners did not deserve this compensation.

* Paul Forrester is a fifth-year student in the philosophy Ph.D. program at Yale. Before that, he earned his BA in political science and philosophy from Duke. He specializes in ethics, political philosophy, and philosophy of social science, and he is especially interested in interdisciplinary approaches to issues such as housing, climate change and emerging technologies.

SHARE

POST:

Enter your email address to subscribe to our monthly newsletter: